Choosing the right health insurance plan for your family in 2025 is an essential decision. With rising healthcare costs and new coverage options, families need to understand what each plan offers. This guide will help you compare top-rated family health insurance plans so you can make a smart and secure choice.

What to Look for in a Family Health Insurance Plan

Start by checking whether the plan covers essential health services. These include doctor visits, prescriptions, emergency care and preventive screenings. Consider out-of-pocket costs, monthly premiums and deductibles. A good plan should offer value without compromising on quality.

Best Private Health Insurance Providers for Families

Private insurance providers continue to lead the market with tailored plans. Each provider offers unique benefits and limitations. Below are the top options based on coverage, affordability and user satisfaction.

Want to know what your policy protects? Read What Does Homeowners Insurance Actually Cover? and compare it with What Does Renters Insurance Actually Cover?. Also check the Best and Worst Homeowners Insurance Companies before you choose a provider.

Explore the Difference Between HMO and PPO and compare Term vs Whole Life Insurance. For drivers check Auto Insurance Quotes or find the Best Full Coverage Auto Insurance in 2025. Visit Insurance.com for more insights.

Blue Cross Blue Shield Family Plan

This provider offers comprehensive coverage across most states. Their plans include pediatric dental and vision along with regular doctor visits.

Highlights:

- National network of providers

- Great telehealth options

Table: Pros and Cons

| Pros ✔ | Cons ❌ |

|---|---|

| Covers preventive services | May have high premiums |

| Wide provider network | Not all services covered in rural areas |

Kaiser Permanente Family Plan

Kaiser focuses on integrated care with its own network of doctors. This improves communication and service delivery.

Highlights:

- Strong wellness programs

- Low out-of-pocket maximums

Table: Pros and Cons

| Pros ✔ | Cons ❌ |

| Coordinated care system | Available in limited regions |

| Great customer satisfaction | Requires using Kaiser facilities |

UnitedHealthcare Family Plan

UnitedHealthcare gives families access to a large network and extra perks like gym memberships and 24-7 nurse lines.

Highlights:

- Variety of plan options

- Strong digital tools

Table: Pros and Cons

| Pros ✔ | Cons ❌ |

| Health savings account options | Some plans have narrow networks |

| Strong mobile app | Higher costs in some states |

Government Health Insurance Plans for Families

Public programs like Medicaid and CHIP are available for low-income families. These options can be helpful if you qualify based on income or household size.

Medicaid Family Plan

Medicaid offers essential care at little or no cost. It varies by state but covers everything from prescriptions to hospital visits.

Table: Pros and Cons

| Pros ✔ | Cons ❌ |

| Low or no cost | Eligibility restrictions apply |

| Includes dental and vision for kids | Limited provider access in some states |

CHIP (Children’s Health Insurance Program)

CHIP is a reliable plan that covers uninsured children from low-income families who do not qualify for Medicaid.

Table: Pros and Cons

| Pros ✔ | Cons ❌ |

| Affordable care for kids | Limited adult coverage |

| Covers checkups and vaccines | Eligibility rules vary |

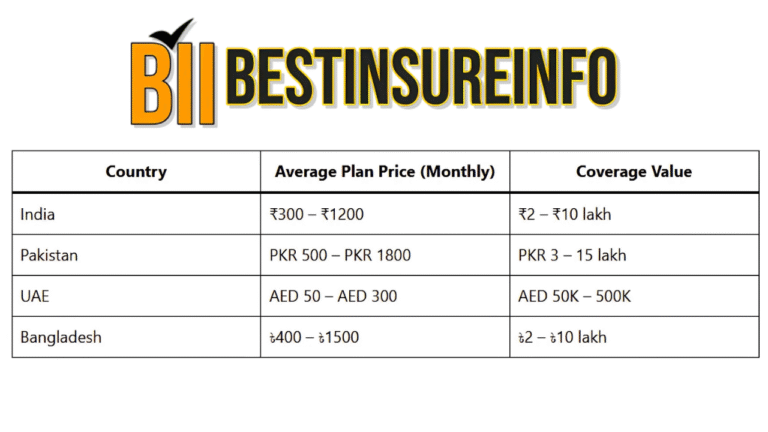

Comparing Family Plan Costs in 2025

Costs can vary widely depending on the provider and location. Premiums are expected to rise slightly in 2025 due to inflation and increased healthcare demand. Choose a plan that balances monthly cost with good benefits.

Key Cost Factors:

- Monthly premium

- Deductibles

- Out-of-pocket limits

- Co-payments for visits and prescriptions

Affordable Family Health Insurance Plans

If you are looking for a budget-friendly option, several insurers offer low-cost family plans with good benefits. Check for subsidies through the Health Insurance Marketplace. These can reduce your premium based on income.

Tip: Use the Best Insure Info [https://lahoribooks.com/] to compare different plans and find your best match.

Best Health Insurance Plans by Family Size

Your family size plays a key role in choosing the right plan. A couple with one child may have very different needs than a family of five.

For Small Families

Plans with low deductibles and flexible doctor access work best. You may not need as many add-ons.

For Large Families

Choose a plan with lower out-of-pocket costs. Look for discounts on bulk prescriptions or family doctor coverage.

Health Insurance with Wellness Benefits

Many top plans now offer wellness features. These include access to health coaches, nutrition tips and gym memberships.

Popular Features:

- Free annual physicals

- Discounts on weight loss programs

- Mental health support

PPO vs HMO for Family Coverage

Know the difference between PPO and HMO. PPO plans allow more flexibility in choosing providers. HMO plans often cost less but require referrals.

Bullet Points:

- PPOs let you see any specialist without a referral

- HMOs require a primary care provider for coordination

Tips for Choosing the Best Family Plan

Use these tips when picking your plan:

- Look beyond the monthly premium

- Check the provider network in your area

- Review prescription coverage options

- Ask about telemedicine and wellness tools

Short-Term Health Insurance for Families

Short-term plans are useful during job transitions or when waiting for open enrollment. They offer basic protection but may exclude pre-existing conditions.

Only use these if you are between plans and need temporary coverage. Always read the fine print before choosing a short-term plan.

Dental and Vision Insurance for Families

Some health plans do not include dental or vision. These are important especially for kids. Consider bundling dental and vision insurance with your main policy.

Tip: Check the Best Insure Info [https://lahoribooks.com/] for bundled options that include dental and vision care.

✅ Frequently Asked Questions

✅ What is the best health insurance for families in 2025?

✅ How much does family health insurance cost in 2025?

Costs vary but expect to pay between $900 and $1700 monthly depending on your plan and location.

✅ Can I switch plans during the year?

You can only switch during open enrollment or after a qualifying life event like marriage or job loss.

✅ What if I cannot afford health insurance for my family?

Check for government programs like Medicaid or CHIP. You may also qualify for subsidies through the Health Marketplace.

✅ Do all plans cover pediatric dental and vision?

Not all plans include dental and vision for children. Look for this feature or buy a separate policy.

Final Thoughts

Choosing health insurance for your family in 2025 requires careful research. Compare coverage options, provider networks and extra benefits. Use online tools like Best Insure Info [https://lahoribooks.com/] to explore your best fit. A good plan should support your family’s health without breaking the bank.