A standard health insurance plan offers a wide range of benefits for individuals and families. It helps manage medical costs by covering essential services. This kind of plan provides peace of mind during unexpected health emergencies. Understanding what is covered can help you make informed decisions about your healthcare needs.

H2: Hospitalization Coverage

A standard health insurance plan covers expenses related to hospital stays. This includes room rent, nursing charges and medical treatment during the stay. It also takes care of charges for surgeries and ICU if needed. These benefits offer critical support during emergencies. Always check the policy documents for the number of days and coverage limits.

Want to know what your policy protects? Read What Does Homeowners Insurance Actually Cover? and compare it with What Does Renters Insurance Actually Cover?. Also check the Best and Worst Homeowners Insurance Companies before you choose a provider.

Explore the Difference Between HMO and PPO and compare Term vs Whole Life Insurance. For drivers check Auto Insurance Quotes or find the Best Full Coverage Auto Insurance in 2025. Visit Insurance.com for more insights.

H2: Pre and Post-Hospitalization Expenses

Health insurance usually pays for medical expenses before and after hospitalization. This includes doctor consultations, diagnostic tests and medicines. The period is usually 30 days before and 60 days after hospitalization. These features ensure the complete care cycle is supported. Timely care before and after treatment makes a big difference in recovery.

H2: Daycare Procedures

Many modern treatments do not need a full-day hospital stay. Health insurance plans cover these daycare procedures. It includes chemotherapy, dialysis and cataract surgery. These treatments are listed in the policy document. Always confirm how many procedures are covered under your plan. This benefit ensures access to advanced care without long admissions.

H2: Ambulance Charges

Ambulance services are needed in emergencies. A standard health plan usually covers ambulance charges. This includes the cost to transport the patient to the hospital. There is often a cap on the amount. Always review your policy for the maximum limit allowed. Quick ambulance service saves valuable time during medical emergencies.

H2: Maternity Benefits

Some health insurance plans offer maternity benefits. These include delivery costs and sometimes cover newborn baby care. There may be a waiting period before you can use this benefit. Always read the fine print in your policy. Maternity cover is helpful for couples planning a family.

H2: Preventive Health Checkups

Preventive checkups help detect health issues early. Many plans offer free yearly checkups. These include blood tests, cholesterol tests and other basic screenings. It helps track your health status regularly. Preventive care can reduce the risk of serious conditions. This feature encourages early action and timely treatment.

H2: Mental Health Coverage

Modern health insurance also includes mental health services. It covers consultations and therapy sessions. Depression, anxiety and other conditions are now recognized. These services are important for overall wellness. Check your policy to know the limits and approved centers. Mental health support is gaining importance in standard plans.

H2: AYUSH Treatments

AYUSH stands for Ayurveda, Yoga, Unani, Siddha and Homeopathy. Some insurance plans now cover these treatments. These are alternate medical systems approved by the government. People who prefer natural remedies can benefit from this. Always confirm the hospital or center is recognized under the plan. AYUSH coverage increases your treatment options.

H2: COVID-19 and Pandemic Coverage

Standard plans now include coverage for COVID-19 and other pandemics. This includes tests, treatment and quarantine costs. Some plans also cover home treatment if advised by a doctor. Pandemic coverage became crucial during recent health crises. Review the exact conditions under which the benefits apply. Coverage can vary by insurer.

H2: Organ Donor Expenses

Organ transplant procedures are very expensive. A standard health plan often covers the cost related to the donor. This includes the screening, surgery and hospital stay of the donor. It does not cover the cost of the organ. Make sure your plan mentions this benefit. It helps reduce costs in critical transplant cases.

H2: In-Patient Care Benefits

In-patient care includes the treatment received when admitted for over 24 hours. Standard health insurance covers this completely. It includes surgery, treatment, room rent and specialist care. These benefits apply in both private and government hospitals. Confirm the list of network hospitals with your provider. Cashless treatment is usually available.

H2: Prescription Medicines

After discharge, patients need medicines to recover fully. Most plans cover prescription drugs. These must be related to the hospitalization or approved treatments. Always keep the bills and prescriptions for claims. This coverage reduces the burden of ongoing medication costs. It supports a smoother recovery process.

H2: Domiciliary Hospitalization

This feature covers treatment taken at home when hospital admission is not possible. It applies in cases where hospital beds are unavailable or patient condition demands home care. Coverage may come with terms and conditions. Not all plans include this benefit. Check with your insurer if this is important to you.

H2: Network Hospital Coverage

Insurance companies have tie-ups with several hospitals. These are called network hospitals. You get cashless treatment at these hospitals. Always check the list provided by your insurer. Network hospitals reduce out-of-pocket expenses. It also ensures better coordination during emergencies.

H3: Pros and Cons Table

| Feature | Pros ✔ | Cons ❌ |

|---|---|---|

| Hospitalization | Covers major expenses | Room rent limit may apply |

| Mental Health | Support for emotional wellness | Often has low coverage limit |

| Maternity | Helps with delivery costs | Long waiting period |

| Daycare | Modern treatments covered | Not all procedures included |

| AYUSH | Alternative treatment options | Limited approved centers |

H2: Tips for Choosing the Right Plan

- Always check for waiting periods and sub-limits

- Compare network hospitals and cashless facility

Look for a plan that suits your age and lifestyle needs. A good health insurance plan is an investment in your well-being. Review the benefits and exclusions in detail. Take expert help if required before finalizing the plan. Never buy a policy in a rush.

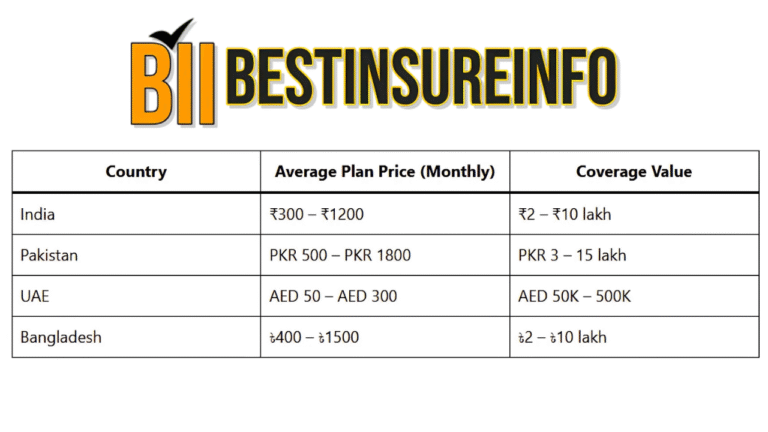

H2: Cost and Premium Factors

Premiums depend on age, lifestyle and coverage amount. Younger people pay lower premiums. Add-on covers increase the cost. Choose your sum insured wisely. Use online tools to compare different plans. Affordable plans may not offer complete benefits. Always balance cost with coverage needs.

H2: Best Insure Info Resources

For more information on health insurance options and latest updates, visit Best Insure Info. The website offers guides, comparisons and expert tips. Use it to explore plans that fit your needs. Reliable content can help you make better choices. Bookmark it for future reference and plan renewals.

H2: Frequently Asked Questions

✅ What does a standard health insurance plan include?

It includes hospitalization, daycare procedures, ambulance charges and post-treatment care. Some plans also offer mental health and maternity coverage.

✅ Is preventive care covered in all plans?

Not all plans offer preventive health checkups. Some insurers include it as a bonus benefit. Always confirm this feature before buying a plan.

✅ Are alternative treatments like AYUSH covered?

Yes many standard plans now include AYUSH treatments. They must be done at government-approved centers. Always check the policy terms.

✅ Do all plans cover COVID-19 treatment?

Most plans now cover COVID-19 related treatments. However, the conditions may differ by insurer. Always review the terms of pandemic coverage.

✅ How do I find network hospitals?

Your insurance provider gives a list of network hospitals. These offer cashless treatment. Check this list online or in the policy document.

A standard health insurance plan offers a strong foundation for medical needs. It supports you during planned and emergency care. Knowing what is covered helps in better claim management. Explore options on Best Insure Info to find the right coverage. Stay protected with a plan that fits your life.