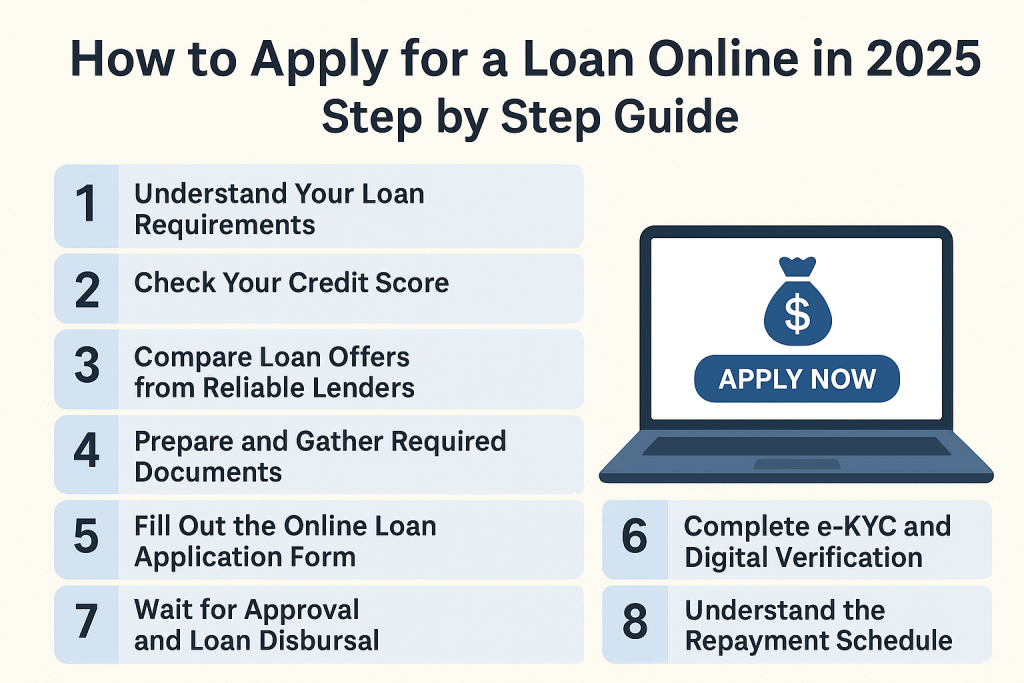

Applying for a loan online in 2025 is faster, safer, and more convenient than ever before. Financial institutions, digital banks, and fintech companies have adopted advanced online systems to make the borrowing process completely paperless. Whether you are applying for a personal loan, business loan, or home loan, understanding the process step by step can save time, reduce errors, and increase your chances of approval.

This detailed guide explains everything you need to know — from preparation to disbursal — along with key benefits, drawbacks, and commonly asked questions.

1. Understand Your Loan Requirements

Before applying, clearly define why you need the loan and how much you actually need. Choosing the right loan type ensures that you get suitable terms and avoid unnecessary borrowing.

Examples of common loan types include:

- Personal Loans – For general purposes such as medical expenses, weddings, or travel.

- Education Loans – For tuition and academic costs.

- Home Loans – For buying or renovating a house.

- Business Loans – For expanding or starting a business.

- Vehicle Loans – For purchasing cars or bikes.

It’s a good idea to use an online EMI calculator to estimate your monthly payments and avoid financial strain later.

2. Check Your Credit Score

Credit score is a critical factor for online loan approval. Lenders analyze your credit history to assess risk. A higher score usually results in better interest rates and faster approvals.

Typical credit score categories:

- 750+ – Excellent

- 700–749 – Good

- 650–699 – Fair

- Below 650 – Poor

If your credit score is on the lower side, work on improving it before applying by paying bills on time, clearing outstanding debts, and limiting new credit inquiries.

3. Compare Loan Offers from Reliable Lenders

Do not settle for the first loan offer you see. Interest rates, fees, and terms vary between lenders. Take time to compare offers from:

- Reputed banks

- Non-banking financial companies (NBFCs)

- Certified online lending platforms

Look beyond just the advertised interest rate. Consider processing fees, prepayment conditions, late payment penalties, and overall customer service reputation. Opt for transparent and trusted lenders to avoid fraud.

4. Prepare and Gather Required Documents

Digital loan applications still require basic documentation. Having these ready speeds up the process. Common documents include:

- Government-issued ID (e.g., CNIC, passport)

- Address proof (utility bills, rental agreement)

- Income proof (salary slips, bank statements, tax returns)

- Employment or business information

Most lenders now allow you to upload scanned copies or complete e-KYC verification online.

5. Fill Out the Online Loan Application Form

Visit the lender’s official website or mobile app. Locate the loan application section and fill out the required fields carefully. Include your personal, financial, and employment details. Make sure all information matches your documents to avoid rejections.

6. Complete e-KYC and Digital Verification

In 2025, most lenders use e-KYC (electronic Know Your Customer) to verify identities quickly. This may involve:

- OTP verification on your registered number

- Biometric authentication through the app

- Linking your bank account for income confirmation

This secure process reduces physical paperwork and speeds up approval timelines.

7. Wait for Approval and Loan Disbursal

After submission, the lender reviews your application. Depending on the loan type, approval can take anywhere from a few minutes to a few days. Once approved, you receive a sanction letter detailing the loan amount, interest rate, tenure, EMI schedule, and terms.

After accepting the offer, the loan amount is credited directly to your bank account.

8. Understand the Repayment Schedule

Before finalizing, carefully review the repayment plan. Check:

- EMI amount and due dates

- Auto-debit options

- Penalties for late payments

- Prepayment or foreclosure terms

Setting up auto-debit ensures timely payments, helping maintain a strong credit score.

Pros and Cons of Applying for a Loan Online in 2025

| Pros | Cons |

|---|---|

| ✅Fast and convenient process | ❌Higher risk of scams if using unverified platforms |

| ✅Paperless and secure verification | ❌Strict credit score requirements |

| ✅Instant approvals in many cases | ❌Limited negotiation on terms compared to in-branch |

| ✅Easy comparison of multiple offers | ❌Over-borrowing temptation due to quick availability |

| ✅Flexible repayment options | ❌Some lenders may charge hidden fees if unchecked |

Smart Tips for a Hassle-Free Experience

- Always apply through official and secure websites.

- Avoid multiple applications at the same time to protect your credit score.

- Read all terms and conditions carefully.

- Borrow only what you need and can repay comfortably.

- Keep your financial documents updated and ready.

Frequently Asked Questions (FAQs)

1. Can I get a loan online without visiting the bank?

Yes. Most banks and lenders in 2025 offer completely digital loan processing. From application to disbursal, everything can be done online through official portals or mobile apps.

2. How long does online loan approval take?

For personal loans, many lenders offer instant approvals within minutes. However, some loans, especially business or home loans, may take a few days for document verification.

3. What is the minimum credit score needed for online loans?

While it varies by lender, a score of 700 or above is generally recommended for better approval chances and lower interest rates.

4. Are online loan applications safe?

Yes, provided you apply through legitimate banks, NBFCs, or regulated fintech platforms. Avoid unknown websites or lenders who promise guaranteed approval without verification.

5. Can I prepay or close my loan early?

Most lenders allow prepayment or foreclosure, but they may charge a small fee. Always review the terms before signing the agreement.

6. What happens if my loan application is rejected?

If rejected, check the reason, improve your credit profile, and reapply after addressing the issue. Avoid multiple immediate reapplications to prevent credit score damage.