Understanding how much health insurance costs monthly is important for anyone who wants to protect their health and budget. Prices vary depending on several factors including age plan type and location. In this article you will find a detailed breakdown of costs coverage options and the pros and cons of different plans.

Factors That Affect Monthly Health Insurance Cost

Many people wonder why their health insurance cost is higher or lower than someone else’s. The reason is that insurance providers consider several personal and regional factors before deciding on a monthly premium. These factors make a big difference in what you pay each month.

Age and Health Status

Younger individuals generally pay less for health insurance. As people grow older their chances of needing medical care increase. Insurance companies often charge higher premiums for those in older age brackets or those with pre existing conditions.

Want to know what your policy protects? Read What Does Homeowners Insurance Actually Cover? and compare it with What Does Renters Insurance Actually Cover?. Also check the Best and Worst Homeowners Insurance Companies before you choose a provider.

Explore the Difference Between HMO and PPO and compare Term vs Whole Life Insurance. For drivers check Auto Insurance Quotes or find the Best Full Coverage Auto Insurance in 2025. Visit Insurance.com for more insights.

Location and State Regulations

Where you live plays a major role in the price of your monthly health insurance. Some states have more insurance providers and stronger competition which usually lowers prices. Others have state rules that increase the cost of premiums for residents.

Type of Plan Chosen

Different types of health plans offer different levels of coverage. For example Health Maintenance Organization HMO plans are generally cheaper but have limited choices for doctors. Preferred Provider Organization PPO plans cost more but offer greater flexibility.

Income and Subsidies

Low income individuals may qualify for government subsidies which lower their monthly costs. The Affordable Care Act ACA provides tax credits to help cover premiums. This makes insurance more affordable for many families and individuals.

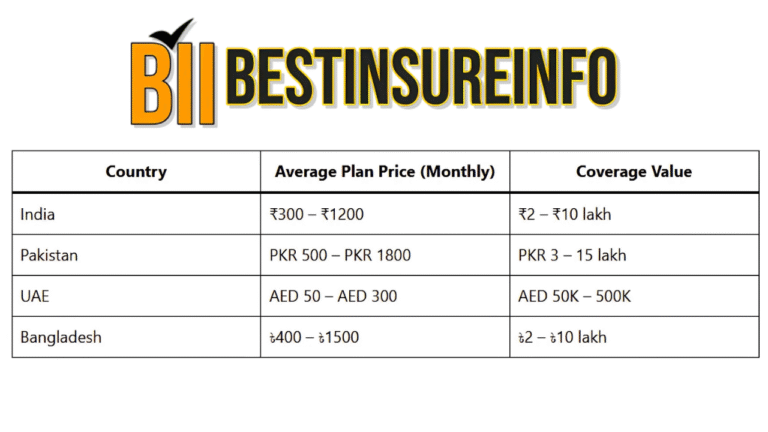

Average Monthly Health Insurance Cost

The average monthly cost of health insurance in the United States is around $450 for an individual and $1150 for a family. These numbers can change based on the type of plan and location. Always compare plans before making a choice to find one that fits your budget and health needs.

Individual Plan Costs

Most individuals who do not receive insurance through their employer will pay between $300 and $600 each month. Bronze plans cost less but cover fewer services. Gold plans cost more but provide more comprehensive coverage.

Family Plan Costs

Family plans typically range from $800 to $1500 per month. The final price depends on the number of people covered and the ages of family members. A plan for two healthy adults will cost less than a plan covering parents with children or older dependents.

Types of Health Insurance Plans

Understanding the different types of plans helps you choose the right one. Each has its own benefits and limitations. Pick a plan that balances cost and coverage according to your needs.

HMO Health Maintenance Organization

HMO plans require you to choose a primary doctor and get referrals to see specialists. They are usually cheaper but limit your choices to a set network of doctors and hospitals.

PPO Preferred Provider Organization

PPO plans allow you to see any doctor without a referral. You pay less if you stay in network but you can go outside the network if needed. These plans offer more flexibility but cost more monthly.

EPO Exclusive Provider Organization

EPO plans are like HMO plans but do not require referrals. You must stay within the plan’s network for coverage. These are great if you want a balance between cost and access.

POS Point of Service

POS plans blend HMO and PPO features. You need a referral to see specialists but you can see doctors outside the network for a higher fee. They offer middle ground flexibility.

Additional Costs Beyond Monthly Premiums

Monthly premiums are not the only expense in health insurance. You must also account for deductibles copays and coinsurance. These add up and impact the real cost of care.

Deductibles

A deductible is the amount you pay before your insurance starts to cover costs. Lower premiums often come with higher deductibles. You should consider how often you expect to need care when choosing a deductible.

Copays and Coinsurance

Copays are fixed amounts you pay for certain services like doctor visits. Coinsurance is the percentage you pay for services after meeting your deductible. These costs affect your total health expenses each year.

How to Lower Monthly Health Insurance Costs

There are several ways to reduce what you pay each month for health insurance. Knowing your options can help you save money while staying protected. Here are some simple methods:

- Choose a high deductible plan if you are generally healthy

- Apply for ACA subsidies if your income qualifies

- Use preventative care to avoid costly treatments later

Pros and Cons of Health Insurance Plans

| Plan Type | ✔ Pros | ✖ Cons |

|---|---|---|

| HMO | Lower monthly costs Easy to manage care | Limited doctor choices Need referrals |

| PPO | Wide provider network No referrals needed | Higher monthly costs May pay more out of pocket |

| EPO | Affordable with some flexibility | No out of network coverage |

| POS | Combination of PPO and HMO features | Requires referrals and more management |

Choosing the Right Health Insurance Plan

Picking the right health insurance depends on your health needs and budget. Young healthy people might benefit from a low premium plan with high deductibles. Families and older adults may want a more comprehensive plan even if it costs more monthly.

Compare Plan Benefits

Always compare plan benefits side by side. Look at what services are included the cost of prescriptions and the network of doctors. Consider what matters most to you and how often you visit healthcare providers.

Check Coverage Details

Review what each plan covers in detail. Some plans may not cover mental health dental or vision. Make sure the coverage aligns with your needs to avoid surprise expenses later.

Use Online Tools

Websites like Best Insure Info offer tools to compare different health insurance plans. You can review costs benefits and provider networks before making a decision. Visit Best Insure Info to explore available options.

Frequently Asked Questions

✅ What is the average monthly cost of health insurance?

✅ Can I get health insurance if I have a pre existing condition?

Yes health insurance providers cannot deny coverage based on pre existing conditions under the ACA. You may still pay more depending on the plan.

✅ Are ACA subsidies available for everyone?

Subsidies are based on your income and family size. Many low and middle income households qualify. You must apply through the ACA marketplace.

✅ What does a deductible mean in health insurance?

A deductible is the amount you must pay before insurance covers medical costs. Choosing a higher deductible can lower your monthly premium.

✅ How can I reduce my health insurance premium?

You can reduce your premium by selecting a high deductible plan using preventive care and applying for government subsidies if eligible.

Conclusion

Understanding how much health insurance costs monthly helps you make informed choices. You must weigh all factors including premiums deductibles and provider networks. Use trusted sources like Best Insure Info to compare plans. With the right strategy you can find a plan that meets your health needs and fits your budget.