Health insurance is a key part of financial planning. Choosing between short-term and long-term health insurance depends on your needs. Some people need quick coverage for a short time. Others prefer steady long-term protection. Understanding both options helps you decide what suits you best.

What Is Short-Term Health Insurance?

Short-term health insurance offers temporary coverage. It is ideal when you are between jobs or waiting for other insurance to start. These plans usually last a few months. Some may extend up to a year depending on your state laws. These plans do not include all essential health benefits.

What Is Long-Term Health Insurance?

Long-term health insurance offers continuous coverage. It includes preventive care and essential benefits. This type of plan is often available through employers or private insurers. Coverage usually lasts a year or more. Many people renew it yearly to maintain uninterrupted protection.

Who Should Choose Short-Term Plans?

Short-term plans are good for people who need insurance for a short time. If you are in between jobs or missed open enrollment this plan can help. It is also useful for students or travelers. These plans do not require long commitments and start quickly.

Want to know what your policy protects? Read What Does Homeowners Insurance Actually Cover? and compare it with What Does Renters Insurance Actually Cover?. Also check the Best and Worst Homeowners Insurance Companies before you choose a provider.

Explore the Difference Between HMO and PPO and compare Term vs Whole Life Insurance. For drivers check Auto Insurance Quotes or find the Best Full Coverage Auto Insurance in 2025. Visit Insurance.com for more insights.

Who Should Choose Long-Term Plans?

Long-term health insurance suits those looking for ongoing medical support. It is ideal for families and individuals with chronic conditions. It is also helpful if you want access to a wide network of providers. These plans ensure long-term stability in healthcare access.

Benefits of Short-Term Health Insurance

Short-term health insurance offers quick approval and flexible terms. These plans have lower monthly costs. They start fast and can fill gaps in coverage. If you are in transition they offer basic protection without long-term commitment.

Benefits of Long-Term Health Insurance

Long-term plans provide consistent medical care. They cover preventive services and major treatments. You can build a lasting relationship with your doctors. These plans often include mental health care and prescription drugs. They offer peace of mind and better long-term value.

Drawbacks of Short-Term Plans

Short-term insurance lacks many standard benefits. These plans may exclude pre-existing conditions. They might not cover mental health or maternity care. Limited provider networks can restrict your choices. You may need to pay more out of pocket during an emergency.

Drawbacks of Long-Term Plans

Long-term plans can be expensive. Monthly premiums and deductibles are higher. You may need to commit for a full year. Enrollment is limited to certain periods. If you miss open enrollment you must wait or qualify for a special event.

Comparing Short-Term vs Long-Term Insurance

Coverage and Benefits

Short-term plans cover basic services. Long-term plans include comprehensive benefits. If you want full medical support go for a long-term plan. Short-term options are better for short-lived needs.

Cost Differences

Short-term plans cost less monthly. Long-term plans have higher premiums but cover more. Choose based on your budget and medical needs. Higher upfront costs in long-term plans can save more later.

Enrollment Periods

Short-term plans allow enrollment anytime. Long-term plans need enrollment during specific periods. If you missed open enrollment a short-term plan can help until next year.

Provider Networks

Short-term plans often have limited provider access. Long-term insurance offers a wide network. You can choose your preferred doctors and hospitals. This is helpful for managing chronic conditions.

Pros and Cons Table

| Feature | Short-Term Insurance | Long-Term Insurance |

|---|---|---|

| ✔ Pros | • Lower monthly costs | • Comprehensive benefits |

| • Quick approval | • Long-term stability | |

| • Flexible terms | • Wide provider access | |

| ✖ Cons | • Limited coverage | • Higher premiums |

| • No pre-existing condition cover | • Limited enrollment periods | |

| • Short duration | • Year-long commitment |

Choosing the Right Plan for You

If you only need health insurance for a few months a short-term plan is useful. It covers emergencies and simple needs. If you want protection for long-term health a full plan is better. Think about your lifestyle job and health status.

Government Rules and Guidelines

Short-term plans do not need to follow Affordable Care Act standards. They can deny coverage based on health history. Long-term plans must cover essential health benefits. They cannot reject you for pre-existing conditions. This legal difference affects your access and costs.

When to Consider Switching Plans

You may need to switch from a short-term to a long-term plan after getting a new job. If your short-term coverage ends and you still need care switch to a long-term plan. Changes in life like marriage or having a baby also require better coverage.

Real-Life Example of Plan Choices

Sarah lost her job and needed quick insurance. She chose a short-term plan for three months. Later she got a new job and switched to a long-term employer plan. Her friend James needed surgery and went directly with a long-term plan due to coverage needs.

Coverage Limits and Exclusions

Short-term plans have many exclusions. They may not cover checkups or chronic illnesses. Long-term plans include preventive care and long-term treatments. You need to read the fine print before choosing a plan.

Health Needs Assessment

Review your health needs before choosing a plan. List any medications you take or treatments you need. Check if a plan covers your doctors. Compare monthly payments versus benefits. Make sure the plan suits your lifestyle.

Flexibility and Customization

Short-term plans offer more flexible terms. You can cancel or change them easily. Long-term plans are more structured. They renew yearly and may have contract rules. Flexibility matters if your situation changes often.

Family Coverage Options

Long-term plans are better for family needs. They cover maternity care and children’s checkups. Short-term plans may not cover dependents fully. If you have a family a long-term plan gives full protection.

Support and Customer Service

Long-term plans often include strong customer support. You get help with claims and billing. Short-term plans may offer limited help. A good support team improves your insurance experience.

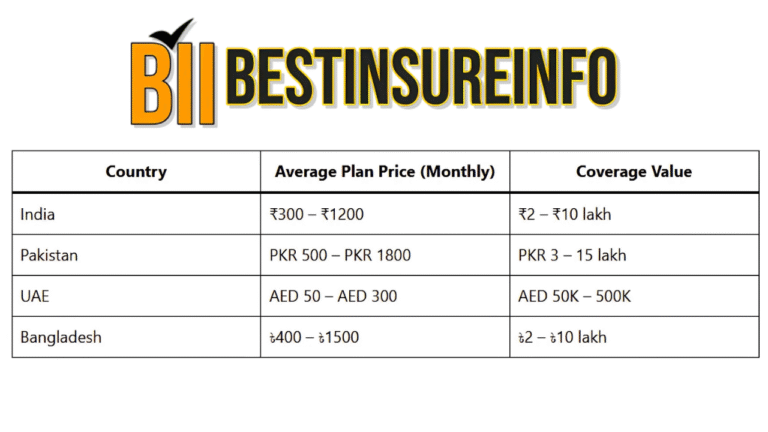

Using Best Insure Info for Guidance

You can learn more by visiting Best Insure Info (https://lahoribooks.com/). It offers expert advice and insurance tips. Compare plans and read guides. Use it to make the best choice for your health insurance needs.

Final Thoughts

Both short-term and long-term health insurance have benefits. Your choice depends on your needs and how long you need coverage. Think about costs and benefits. Use trusted sources and compare plans wisely.

✔ What are the main differences between short-term and long-term health insurance?

✔ Can I switch from short-term to long-term insurance later?

Yes you can switch plans. Many people start with short-term insurance during job gaps and move to long-term plans when eligible. Make sure there is no gap in coverage.

✔ Does short-term insurance cover doctor visits?

Some short-term plans cover doctor visits. Others may only cover emergencies. Always check the details before signing up.

✔ Are long-term plans available outside open enrollment?

Usually long-term plans require open enrollment. But special events like marriage or losing a job may let you enroll at other times.

✔ Is short-term insurance good for students?

Yes short-term plans are helpful for students who need temporary coverage. They are budget-friendly and offer basic protection during transitions.