When choosing a health insurance plan you will often come across HMO and PPO options. Both serve the same purpose of providing medical coverage but they function differently. Understanding the difference can help you choose the right plan for your lifestyle and medical needs. This article explores HMO and PPO plans in detail.

What Is an HMO Plan?

HMO stands for Health Maintenance Organization. This type of health insurance plan requires members to choose a primary care physician. All healthcare services must go through this doctor. If you need to see a specialist you must get a referral from your primary care physician first.

Key Features of HMO Plans

HMO plans are structured and cost-effective. You must use doctors hospitals and clinics within the plan’s network. These networks are often smaller than PPO networks. If you go outside the network you may have to pay the full cost of care.

What Is a PPO Plan?

PPO stands for Preferred Provider Organization. It offers more flexibility than HMO plans. You can visit any healthcare provider without a referral. PPO plans have a network of preferred doctors but you are not restricted to them. You can see out-of-network providers at a higher cost.

Want to know what your policy protects? Read What Does Homeowners Insurance Actually Cover? and compare it with What Does Renters Insurance Actually Cover?. Also check the Best and Worst Homeowners Insurance Companies before you choose a provider.

Explore the Difference Between HMO and PPO and compare Term vs Whole Life Insurance. For drivers check Auto Insurance Quotes or find the Best Full Coverage Auto Insurance in 2025. Visit Insurance.com for more insights.

Key Features of PPO Plans

PPO plans provide greater freedom. You can choose any doctor or specialist at any time. These plans are ideal for those who want control over their healthcare choices. They also work well if you travel often or live in more than one location throughout the year.

Pros and Cons of HMO and PPO Plans

| Plan Type | Pros ✔ | Cons ❌ |

|---|---|---|

| HMO | Lower monthly premiums | Requires referrals |

| Lower out-of-pocket costs | Limited provider network | |

| Coordinated care system | No coverage outside network | |

| PPO | More provider choices | Higher monthly premiums |

| No referral needed | Higher out-of-pocket costs | |

| Out-of-network coverage | Less coordinated care |

Choosing Between HMO and PPO

Choosing between HMO and PPO depends on your budget and how you prefer to manage healthcare. If you want low cost and do not mind sticking to a network HMO could be right. If you prefer flexibility and direct access to specialists PPO might suit you better.

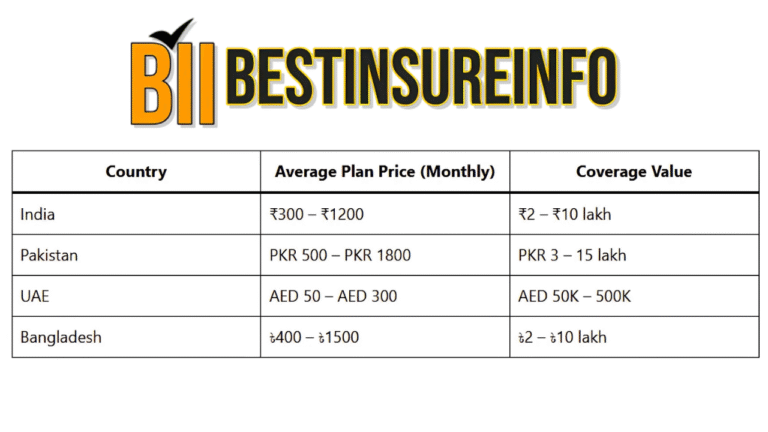

Cost Comparison of HMO and PPO

HMO plans usually cost less each month. They also have lower deductibles and co-pays. PPO plans cost more but offer better access to providers. You pay more for convenience and freedom of choice. Evaluate your finances and health needs before deciding.

Access to Healthcare Providers

HMO plans limit your access to only in-network providers. PPO plans allow access to out-of-network providers but at a higher cost. If you already have doctors you trust check if they are in the plan’s network before enrolling.

Referral Requirements

With HMO you need a referral to see any specialist. This can delay treatment but helps manage overall care. PPO does not require referrals. You can book appointments with specialists directly. This speeds up the process of getting care.

Quality of Care and Coordination

HMO plans promote coordinated care through a primary doctor. This helps manage chronic conditions. PPO plans offer less coordination but more choice. You manage your care independently which may suit experienced healthcare users.

Emergency Care Coverage

Both HMO and PPO cover emergency services. If you are in an emergency you can seek care at the nearest hospital. You do not need to worry about network rules during emergencies. Always check your plan’s emergency policy for details.

Travel and Coverage

If you travel often PPO plans give you peace of mind. They offer coverage across the country and sometimes internationally. HMO plans may only cover emergencies outside your local area. Frequent travelers may prefer PPO plans.

Prescription Drug Coverage

Most HMO and PPO plans include drug coverage. Formulary lists may vary. Check the list to see if your prescriptions are covered. PPO plans may have more options for pharmacies. Always compare drug costs under each plan.

Ideal Users for HMO

HMO plans work well for those who want a simple plan and low costs. If you rarely need specialist care and want one doctor to manage your health an HMO might be best. It suits individuals who live in one location.

Ideal Users for PPO

PPO plans suit those who prefer more control over their healthcare. If you want to see specialists without waiting or travel often PPO is ideal. It is also good if you have complex health needs requiring multiple providers.

Differences in Claims Process

HMO plans handle claims directly with in-network providers. You usually do not have to submit claims. PPO plans may require you to file claims if you go out-of-network. Always keep documentation for out-of-network services.

Enrollment Periods

Both HMO and PPO plans have specific enrollment periods. You can sign up during open enrollment or a special qualifying event. Missing these periods could delay coverage. Be aware of deadlines and mark them on your calendar.

Common Misconceptions

Some believe HMO plans offer lower quality care. That is not true. HMO plans offer quality care within a managed network. Others think PPO plans are always better. That depends on how much flexibility you need and your budget.

Expert Tips for Choosing

- Compare premium and out-of-pocket costs

- Check if your preferred doctors are in the network

- Review the drug formulary list

- Understand the referral process

- Think about your travel and healthcare habits

Real Life Example of Choosing HMO

Sarah is a healthy woman who only sees her doctor once a year. She lives in one city and prefers low monthly payments. She chooses an HMO plan. It gives her all the coverage she needs at a lower cost.

Real Life Example of Choosing PPO

James travels often for work and sees several specialists for his health condition. He chooses a PPO plan. It allows him to get care wherever he is without referrals. He pays more but enjoys peace of mind and control.

How to Switch Plans

You can switch between HMO and PPO during the open enrollment period. Compare plans during this time. Contact your insurance provider for help with switching. Make sure there is no gap in your coverage when you change plans.

✔ Frequently Asked Questions

✔ What does HMO mean in health insurance?

✔ What does PPO stand for in insurance?

PPO means Preferred Provider Organization. This plan lets you visit any healthcare provider without a referral. You get more freedom but may pay more for services.

✔ Is a PPO better than an HMO?

It depends on your needs. PPO plans offer more flexibility but at a higher cost. HMO plans cost less but limit your provider choices. Evaluate what matters most to you.

✔ Can I use both HMO and PPO?

You can only have one type of plan at a time. You may be able to switch during the enrollment period. Contact your insurer for more details on switching plans.

✔ Are HMO and PPO available on Best Insure Info?

Yes. You can compare both types of plans on Best Insure Info. They offer tools to help you find the right plan for your budget and health needs.

Conclusion

Understanding the difference between HMO and PPO plans helps you make an informed choice. Think about your healthcare habits your budget and how much flexibility you want. Use tools on trusted sites like Best Insure Info to compare plans and find what works best for you.